Small business is the invisible bank we deal with daily as they take our money and hold it before paying their suppliers or providers of a service they have facilitated. They don’t want to be that bank as it is a complete drain on what they want to do as they now are managing money which comes with extensive costs, resources and risk, which is not why they got into the business.

Being a bank is forced on small businesses due to the constraints of our current money transfer model that you, as a consumer, end up paying for. The current system forces them to take the money in and hold it until they have enough to pay their suppliers or have the people available to do the work to do the payment. As they become a more significant business, they want to operate as an invisible bank as they can extract extra value from this money at the expense of the smaller businesses.

All of this costs money, which must be recovered and added to the consumer’s price. This cost keeps being added down the whole supplier chain.

The problem is that this invisible bank carries many risks with it for all and has none of the controls or protections that the banking system has.

We have seen this recently in the house building industry where developers who are the facilitators between the buyer and the contractors building are going out of business and leaving all high and dry.

Company collapses continue in Australia’s construction industry bloodbath https://www.wsws.org/en/articles/2022/07/27/mmza-j27.html

Bitcoin was the promised land of getting this fixed, but it only made the transfer more direct instead of depending upon middlemen (the banking system) to pass the transaction through to the end person. The problem is that this worked well for high-value transactions but not everyday small businesses. The advent of Ethereum opened the door to fix this with smart contracts in that a payment could be automatically split to any party. Still, it bore high costs, was slow and had set limitations that negated it being used for everyday small transactions, but we see acceptance with more significant transactions.

NFTs opened a new door as they now could hold business rules and have royalty contracts that could change post creation with links to multiple accounts and smart contracts. Also, at the same time, new chains came on board, allowing the transfer cost to drop and faster activity. New chains arriving allow the gas costs to drop by 100x and the speed coming down to sub 2 seconds. We saw this happen when the cloud for web2 was starting, and the costs dropped dramatically over a few short years, allowing a whole new set of business to happen. (I was one of those who benefited from this with real-time live TV engagement in 2010).

We see this opening a new way of handling payments removing the invisible bank and creating massive cost savings, which a business can take as profit or drop the price.

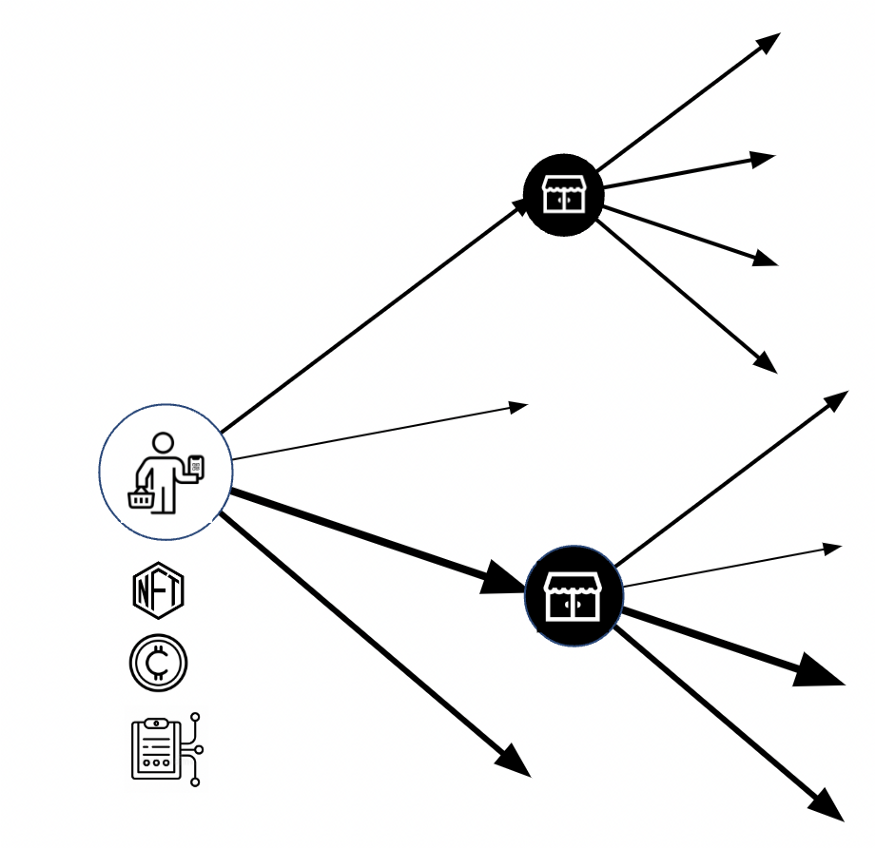

This is all about the payment being split at the start, and the new payment terminals showing QR codes or our phones doing this work add a new level of information to make this possible. And with us using our phones for payment allows the display of the full detail of the transaction, not just approving the settlement as we do currently which improves security and controls. But the big area will be the SDK’s that can be placed into many systems to make this fully automated and open new models of pricing.

Examples of the impact of this.

Think about the Uber driver; they currently wait up to 10 days before getting paid for a drive, and Uber takes 27.5%. The driver then has to take that money and pay everyone else. Under this new model, 5 seconds after you get out of the car, they get paid their part, insurance is paid for the milage done, the fiance company or car owner gets paid as a percentage of the transaction. Uber isn’t a bank or an employer anymore as well as they aren’t paying the driver now, you are, which decreases its costs as well.

Now for a local business like the Yoga studio or the Online Yoga video (what we are already working on). Under the studio model, the teacher gets paid two weeks after the class and normally at the end of the month all others are paid. Now, when you turn up to a class and sign in, the teacher, landlord, insurance and the studio are all paid at once. And the same for the online video; when you watch it, the teacher is getting paid, and as we now don’t have minimum transactions, then $0.10 payment works instead of waiting until the minim amount to payout is reached.

Summary

Splitting the payment at the start to all parties can have a massive impact now, reaching the final objective of no middlemen and being real-time. This means money is flowing, not being held in place and operating under clearly defined rules, a whole new paradigm for money movement that we can trust as it is built on a system of distrust. Just think about GST/VAT we pay in this could be embedded in the transaction and is two-way, how much less work and fraud would happen.

And on a global basis, this 10% is now back flowing in the transaction stream (GDP) with added economic impact and decreasing the risk that the invisible banks has, especially when they fail or have their cashflow crunched.

Come and talk to us as we build out this protocol and support SDKs to make this work. Already have linked to our online Yoga Platform, created a plugin for MindBody Online (80k business use this including our Yoga Studios) and created a QR model that anyone can use.

Peter Tippett

Start blogging about your favorite technologies, reach more readers and earn rewards!

Join other developers and claim your FAUN account now!

Peter Tippett

Co-Founder, vault3.net

@peter_tippettUser Popularity

41

Influence

4k

Total Hits

1

Posts

Only registered users can post comments. Please, login or signup.