The article discusses the potential impact of restaking protocols on Ethereum's staking participation and decentralization.

While such protocols may provide significant financial benefits to validators, they could compromise Ethereum's ability to self-regulate staking participation and to temper centralizing forces.

The article suggests that the logical endgame is an ingrained cap on the size of the active validator set. The economic case for Lido choosing to self-limit their validator set is examined, and the article finds that restaking protocols will likely make the option unfeasible.

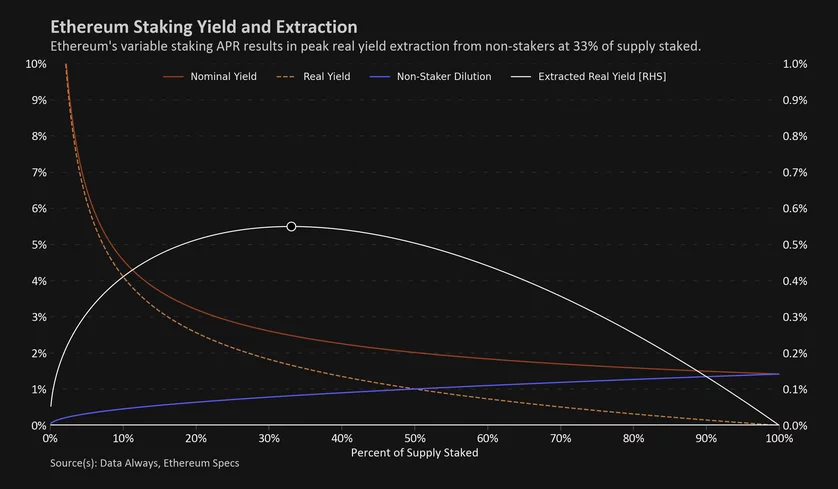

The article argues that Ethereum's long-term challenge is not to get more people to stake, but to get less people to stake, and that a minimum viable issuance policy might be necessary to discourage high staking participation rates. The article also discusses the three classes of stakeholders and their incentives in relation to Lido's self-limiting decision.

Give a Pawfive to this post!

Start writing about what excites you in tech — connect with developers, grow your voice, and get rewarded.

Join other developers and claim your FAUN.dev() account now!