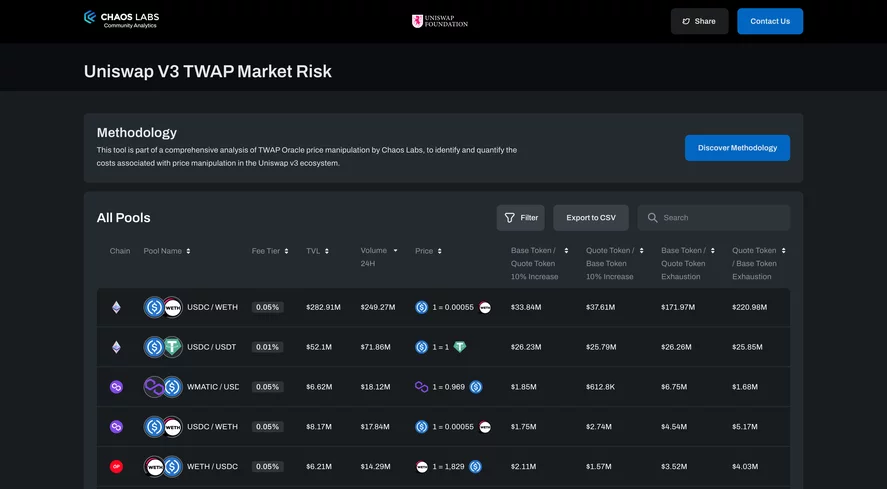

Manipulating Time-weighted average price (TWAP) oracles in decentralized finance (DeFi) can lead to economic exploits. This paper examines the likelihood of manipulating Uniswap's V3 TWAP oracles and proposes strategies to mitigate the risks. Real-life attacks on Moola Market and Mango Markets are discussed as examples. The study explores the feasibility of manipulation and the capital required. The Chaos Labs TWAP Market Risk application provides tools to assess manipulation risks in Uniswap V3 pools.

Give a Pawfive to this post!

Start writing about what excites you in tech — connect with developers, grow your voice, and get rewarded.

Join other developers and claim your FAUN.dev() account now!