Why FinTech companies need specialized SMTP provider

Before we proceed with the reviews, let’s quickly go over why you need specialized transactional email services for FinTech in the first place.

Reliability

First and foremost, you need to make sure your transactional emails, that is, payment confirmations, e-invoices, 2FA codes, new device logins, etc., get delivered instantly with no hiccups whatsoever.

Why? Well, they’re tied to real-time user actions, so even a delay of a few seconds can lead to a failed login or an abandoned transaction. This, in turn, loses users’ trust, which is key in FinTech since there is sensitive data in play.

With this, a specialized SMTP provider can help you by offering the following:

- High delivery speed (~5 seconds)

- Dedicated stream for transactional messages

- Flexible retry logic for handling issues like ISP failure

- High email uptime with transparent downtime reports

Example use case

You own a neobank, a challenger bank, or BNPL app, and your user needs to receive a one-time password (OTP). If the email with the OTP doesn’t arrive in the user’s inbox, they might face account lockout. So, in this case, you don’t just lose trust, but your customer support team gets more unnecessary work on their hands.

Scalability

Unlike with eCommerce companies, whose emails are a bit static (e.g., cart abandonment emails aren’t sent in blasts), in Fintech, emails can be more dynamic due to market shifts. So, your email infrastructure needs to be scalable in order to withstand new feature emails, regional launches, tax notifications, suspicious activity etc.

That is, an SMTP provider needs to be able to handle the increasing load without any bottlenecks or hiccups. To achieve this, a provider should have:

- Cloud-based infrastructure with multiple MTAs

- Support for sending high throughput

- Dedicated streams or at least dedicated IPs

- Deliverability expert support for emergencies

Example use case

You own a crypto exchange, a market cap website, or a trading platform, all of which can acquire a massive number of users in a short time. To register an account, your users need to verify emails, upload documents, connect their digital wallets, make a deposit, etc.

Since the whole account activation process requires you to send them multiple transactional emails, from account confirmations and document approval notifications to welcome emails, your infrastructure needs to be able to withstand the spike in sending volume.

Compliance and auditability

Let’s be honest, if you’re in FinTech, you’re probably knee-deep or at least have been in regulations and compliance. Unfortunately, I have to tell you that there’s a whole lot more of them when it comes to emails.

Namely, since you deal with sensitive information, financial data, or even documents related to identity verification, regulations like GDPR, standards such as PCI DSS, and certifications like ISO 27001 require you to be transparent about user consent, have data protection mechanisms in place, auditable logs, and the list goes on.

Not complying with these usually results in massive fines. Take the CAN-SPAM Act, for instance, which penalizes users for violations with fines of up to $44k per email.

To help you comply with email rules and regulations, and other email marketing laws, an SMTP provider needs to provide you with:

- Custom sending domains so you can align with different policies

- Proper email authentication to prevent malicious attacks

- Detailed event logging that you can use for audits

- Clear and transparent data retention policies

- Access control and multi-tenancy support for your team

- Privacy-first infrastructure with data localization options (i.e., EU-based servers if you’re from EU for regional compliance)

Example use case

You’re sending custom invoices, loan approval, or P2P payments documents that can include sensitive customer information on payment terms, credit scores, etc. To ensure the data doesn’t get into the wrong hands, an SMTP provider needs to enforce TLS and DKIM policies for all outbound emails.

For instance, Mailtrap requires each sender to have proper authentication (SPF, DKIM, DMARC) before they start sending, so each domain is properly checked and prepared.

FinTech transactional email services comparison criteria

Now, let me explain how I came up with the providers on this list and the criteria I used to determine whether they can be the right choice for your FinTech company.

Email infrastructure

Every email deliverability expert out there will tell you that a solid infrastructure consists of four key components: deliverability, reliability, scalability, and separate sending streams.

Deliverability

Email deliverability refers to the SMTP provider’s ability to deliver your emails to your recipients’ inboxes. To achieve a high rate, providers use dedicated IP, have proper IP warmup protocols and authentication, and more. Additionally, they might offer some features to help you increase the performance of your emails as well, such as bounce tracking and inbox placement insights.

However, it’s important to note that deliverability % between providers differs greatly and that sometimes, the advertised deliverability rate also differs from the actual one.

Over at Mailtrap, we wanted to see how big of a difference this is, so we’ve decided to conduct tests with several top SMTP providers. To make the tests fair to everyone, we used:

- A free-tier subscription

- A shared IP environment

- Identical email templates across all providers

- Seed testing for accurate deliverability testing and tracking

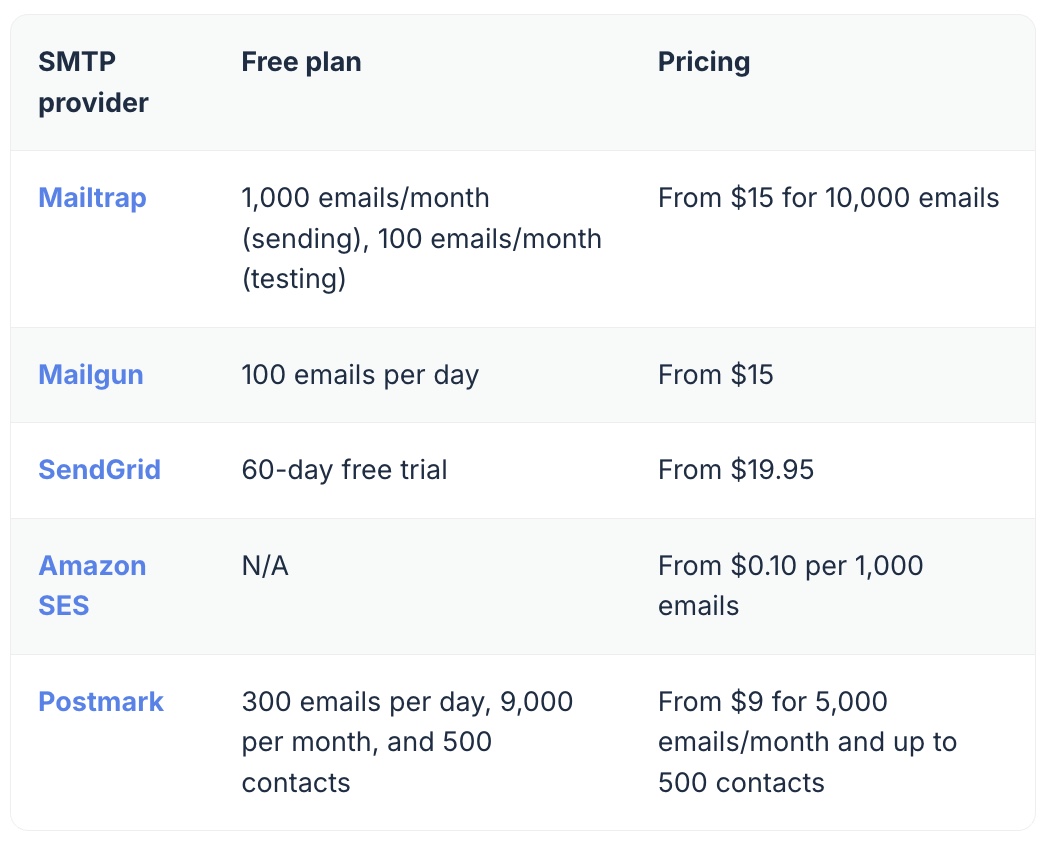

Here’s a table with summarized test results: