Understanding the Go Compiler: The Linker

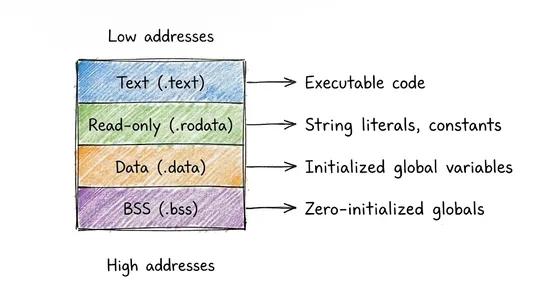

Go’s linker stitches together object files from each package, wires up symbols across imports, lays out memory, and patches relocations. It strips dead code, merges duplicate data by content hash, and spits out binaries that boot clean - with W^X memory segments and hooks into the runtime... read more