Why I’m not worried about AI job loss

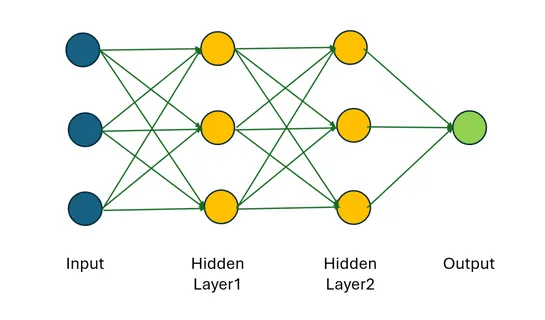

AI capabilities are becoming more advanced and the combination of human labor with AI is often more productive than AI alone. Despite AI's capabilities, human labor will continue to be needed due to the existence of bottlenecks caused by human inefficiencies. The demand for goods and services create.. read more