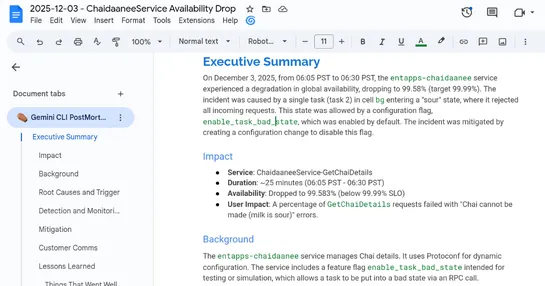

Building a TUI is easy now

Hatchet usedClaude Code, a terminal-native coding agent, to build and ship a real TUI-based workflow manager - fast. Like, days-fast. Powered by theCharm stack(Bubble Tea, Lip Gloss, Huh), it leans hard into CLI-heavy development. Claude Code handled live testing intmux, whipped up frontend views fr.. read more